Regions

Property Types

Find a Multifamily Property for Sale

Featured Apartments - Atlanta & Southeast

2604 Dauphin Street

Mobile , Alabama

Atlanta & Southeast

+ Apartment Buildings

Units: 32

Price: $3,200,000

640 Greenview St

ALBERTVILLE , Alabama

Atlanta & Southeast

+ Apartment Buildings

Units: 72

Price: $3,500,000

Featured Apartments - Boston & New England

65 Belmont Avenue & 886 State Street

Springfield , Massachusetts

Boston & New England

+ Apartment Buildings

Units: 33

Price: $3,500,000

148 Pleasant Street

Boston , Massachusetts

Boston & New England

+ Apartment Buildings

Units: 9

Price: $3,750,000

100 & 100.5 Main Street

Newmarket , New Hampshire

Boston & New England

+ Apartment Buildings

Units: 25

Price: $4,615,000

Featured Apartments - California & West

The Triangle Duplex

Costa Mesa , California

California & West

+ 2-4 Units

Units: 2

Price: $1,799,000

Pacific Crest

Encinitas , California

California & West

+ Apartment Buildings

Units: 21

Price: $15,500,000

1132 W Duarte Rd

Arcadia , California

California & West

+ Apartment Buildings

Units: 20

Price: $9,250,000

Featured Apartments - Chicago & Midwest

PLEASANT APARTMENTS

Richfield , Minnesota

Chicago & Midwest

+ Apartment Buildings

Units: 11

Price: $1,375,000

NICOLLET HOTEL

Saint Peter , Minnesota

Chicago & Midwest

+ Apartment Buildings

Units: 25

Price: $2,200,000

1898 Baldwin Road

Reynoldsburg , Ohio

Chicago & Midwest

+ Apartment Buildings

Units: 24

Price: $3,000,000

Featured Apartments - Florida & Gulf Coast

36 Key North Beach Hotel/Short-Term Rental Assemblage

3 Addresses

Florida & Gulf Coast

+ Apartment Buildings

Units: 36

Price: $18,945,000

132 Isle Of Venice Dr

Fort Lauderdale , Florida

Florida & Gulf Coast

+ Apartment Buildings

Price: $8,800,000

828 NE 17th Ave

Fort Lauderdale , Florida

Florida & Gulf Coast

+ Apartment Buildings

Price: $7,000,000

Featured Apartments - New York & Tri-State

Views at Fishtown

Philadelphia , Pennsylvania

New York & Tri-State

+ Apartment Buildings

Units: 154

Price: $38,000,000

54-Unit Elevator Building in Central Harlem

New York , New York

New York & Tri-State

+ Apartment Buildings

Units: 54

Price: $8,400,000

Featured Apartments - Phoenix & Southwest

240 Thoma Street

Reno , Nevada

Phoenix & Southwest

+ Apartment Buildings

Units: 17

Price: $4,488,000

Featured Apartments - Seattle & Northwest

1431 NW 4th Street

Redmond , Oregon

Seattle & Northwest

+ Apartment Buildings

Units: 20

Price: $7,130,000

144 SW Crowell Way

Bend , Oregon

Seattle & Northwest

+ Apartment Buildings

Units: 15

Price: $6,800,000

419 S Washington St, 425 S Washington St, 320 W. 5th Ave, and 324 W. 5th Ave

Spokane , Washington

Seattle & Northwest

+ Apartment Buildings

Units: 42

Price: $3,250,000

Featured Apartments - Texas

Featured Apartments - Washington DC

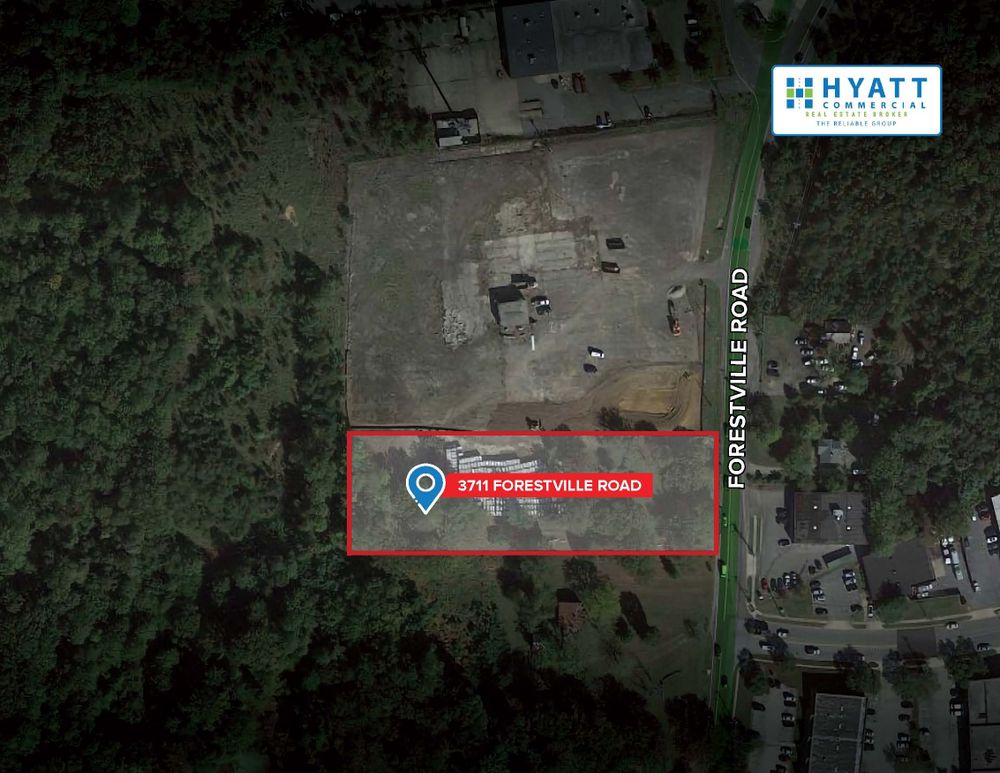

3711 Forestville Rd

District Heights , Maryland

Washington DC

+ Apartment Buildings

Price: $2,000,000

Featured Apartments - Canada

1305 Jervis Street

Vancouver , British Columbia

Canada

+ Apartment Buildings

Units: 24

Price: $10,800,000